|

Site Categories |

|

Featured Items |

Poodle, Spaghetti Trim, Ucagco

|

Colonial Dames Building - $50 Bond - Clubs For Sale

When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

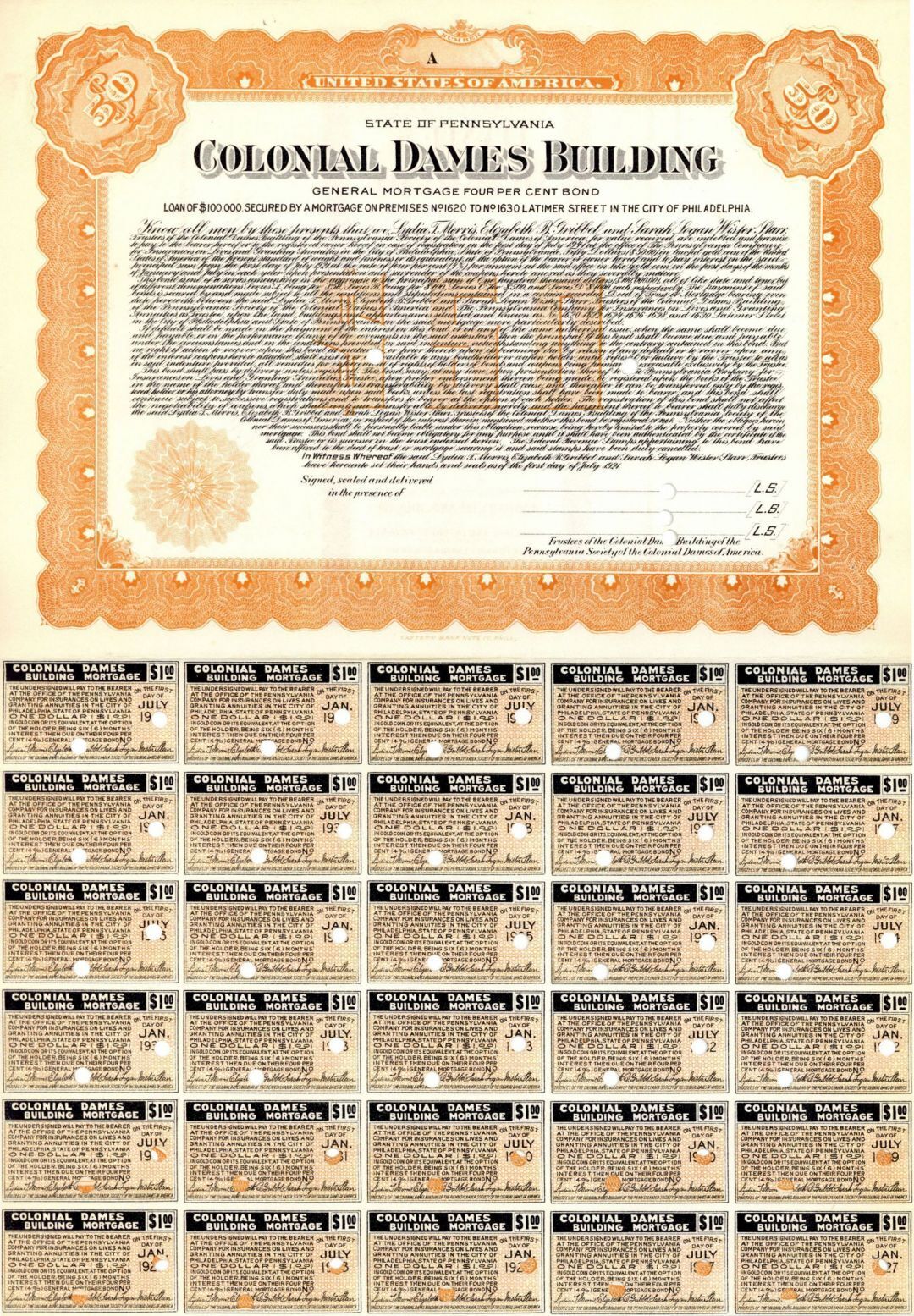

Colonial Dames Building - $50 Bond - Clubs:

$75.00

$50 4% Unissued Bond printed by Eastern Bank Note Co., Phila. In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. The most common types of bonds include municipal bonds and corporate bonds. The bond is a debt security, under which the issuer owes the holders a debt and (depending on the terms of the bond) is obliged to pay them interest (the coupon) or to repay the principal at a later date, termed the maturity date. Interest is usually payable at fixed intervals (semiannual, annual, sometimes monthly). Very often the bond is negotiable, that is, the ownership of the instrument can be transferred in the secondary market. This means that once the transfer agents at the bank medallion stamp the bond, it is highly liquid on the secondary market. Thus a bond is a form of loan or IOU: the holder of the bond is the lender (creditor), the issuer of the bond is the borrower (debtor), and the coupon is the interest. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure. Certificates of deposit (CDs) or short-term commercial paper are considered to be money market instruments and not bonds: the main difference is the length of the term of the instrument. Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in a company (that is, they are owners), whereas bondholders have a creditor stake in the company (that is, they are lenders). Being a creditor, bondholders have priority over stockholders. This means they will be repaid in advance of stockholders, but will rank behind secured creditors, in the event of bankruptcy. Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks typically remain outstanding indefinitely. An exception is an irredeemable bond, such as a consol, which is a perpetuity, that is, a bond with no maturity. (Wikipedia) Item ordered may not be exact piece shown. All original and authentic.

|

|

Related Items:

Colonial Dames Building - $50 Bond - Clubs $75.00

Historical Medal ~ Colonial Dames 17th Century ~ Col Richard Lee VA Genealogy $599.00

Postcard SC Colonial Charleston Cumberland St. Dames of America Sites to Explore $19.99

|

|

|

Shopping Cart  |

|

Recently Viewed |

|

Latest Items |

|

Facebook |

Secure Websites

|